The majority of present decentralized exchanges (DEXs) belong to a particular class of trading platforms called “automated market makers,” or AMMs. These are systems that, often employing a consistent product method, calculate the values of assets by weighing them in decentralized liquidity pools.

AMMs enable everyone to engage in liquidity providers by merely donating assets to one or even more liquidity pools, in contrast to conventional centralized exchanges (CEXs), which frequently require centralized market makers to supply most of their order book depth. They boost the pool’s liquidity in exchange for a portion of the transaction fees it produces. If you are interested in investing in cryptocurrencies, you may consider knowing about Precautions To Take While Investing In Cryptocurrencies.

Where Are You Able To Offer Liquidity?

Most people imagine the type of liquidity that is utilized to support swaps on decentralized exchanges when they think of liquidity. The great majority of liquidity providers solely give liquidity to AMMs, and the vast majority of all bitcoin liquidity is utilized to support these platforms.

DEXes are only one option for individuals to provide liquidity. Several formerly centralized services now have decentralized analogs as the decentralized finance (DeFi) landscape has grown in complexity and diversity; many of them enable users to donate liquidity to aid with operations.

The following are some more platforms that consumers can often supply liquidity to:

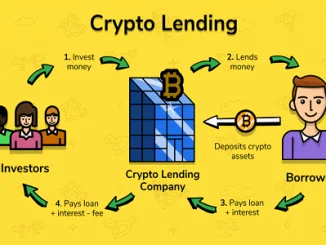

- Open lending guidelines: Compound and Aave, two decentralized lending protocols, have experienced rapid development in recent years and frequently rank among the most well-liked DeFi protocols on supported chains. Liquidity providers often receive a percentage of the interest rate that borrowers pay, and occasionally they may also receive extra compensation in the sort of governance tokens.

- Decentralized Bridges: An increasing number of cross-chain bridges let users provide liquidity to pools on one or more chains to support quick and easy token transfers between them.

- DAOs: As decentralized autonomous organisations become more common, so too has their demand for quick access to funds increased. This capital might be used to finance DAO acquisitions, cover operating costs, and other expenses.

- Decentralized insurance protocols: As DeFi has gained acceptance, users have become more aware of the need to guard against theft, hacking, and other unforeseen occurrences.

Why Do Individuals Offer Liquidity?

In the DeFi ecosystem, providing liquidity is increasingly in demand, and some of the most well-known decentralized exchanges can have tens of thousands of liquidity providers on their own. In general, the majority of liquidity providers have one goal in mind and that is profit.

Most people who offer liquidity do so with the idea that they would receive a reasonable return on their investment, whether it is in the form of fees, returns from farming, or governance token incentives. In a limited percentage of circumstances, users may choose to merely supply liquidity to support their preferred projects, since this protects the token from dramatic price swings and gives new users access to new coins/tokens without experiencing excessive slippage.

What Can LP Tokens Be Used For?

- Transacting between people: Ownership of fundamental tokens locked up in a related liquidity pool is represented by LP tokens.

- Used for liquidity mining or yield farming: Without a question, the most common application of LP tokens is yield farming.

- Obtain a loan backed by them: Users are starting to be able to utilize their LP tokens as collateral for loans through an increasing variety of decentralized lending protocols.

- Delete them: Project owners who have offered liquidity for their tokens occasionally have the option to “burn” the LP tokens that go along with those tokens.

Conclusion

I hope the basics of the liquidity pool tokens have gotten to your insights. Hope to have imparted a better piece of knowledge.

Be the first to comment